Last updated 3.28.22

Wish you could be in a better place financially and making more money but feel that your own mindset around money could be holding you back? Our relationship with money begins very early in life. Our families, friends, communities, spirituality, religion, cultural backgrounds, even the media all play a part in our approach to our finances. Uncover your own money mindset, discover how it could be holding you back and find tools, practices and resources to get you back on track and moving into a place of abundance.

Money mindset magic with Michelle Waymire

Unpack deeply held beliefs around finances to make healthier financial decisions

Taking action with your personal or business finances is crucial to making progress – but so few of us stop to also examine the mental and emotional considerations around our money. Let’s unpack some of our deeply held beliefs around our finances, take stock of which mindsets are helping and harming us, and learn tools to address the past money baggage that holds us back from making healthier financial decisions.

Money mindset exercise: uncover your emotions around money

Grab a pen and a piece of paper and answer the following questions.

Close your eyes and feel into your body. Think about your body – is there tension anywhere? Are you coming into this with a sense of nervousness/anxiety?

On each exhale, release more of that tension. Release any anticipations or expectations you have about this session.

NEXT, WRITE DOWN: WHAT ARE 5 WORDS OR EMOTIONS YOU’D USE TO DESCRIBE MONEY?

Is it…?

- liberating?

- stressful?

- fun?

- a tool?

What is my Money Mindset?

1. Money Mindset:

-

- Your money mindset is a collection of thoughts, feelings, and formative past experiences surrounding your money.

2. Why is your money mindset important?

-

- It’s a relationship you can’t escape.

- Money is a source of power in society and our relationships – but so is having a good mindset.

- It’s only by communicating about our money that we can help impact change in our won lives AND in our communities.

3. Your money mindset vs. taking action with your finances:

-

- Mindset: the gas in your tank, the fuel that gets you to the destination.

- Action: actual mile markers taken and route to get you there.

4. Limitations of money mindset work:

-

- Mindset work doesn’t fix real structural issues with lack and resource allocation.

- There are sometimes real-life challenges and limitations imposed by capitalism.

- Sexism, racism, homophobia, exist.

- COUNTERPOINT: it’s an act of resistance when womxn, POC, LGBTQ+, fox, and other marginalized identities feel confident with their money. This is a way to stand up in a society that pushes so many of us down!

What is your personal money story?

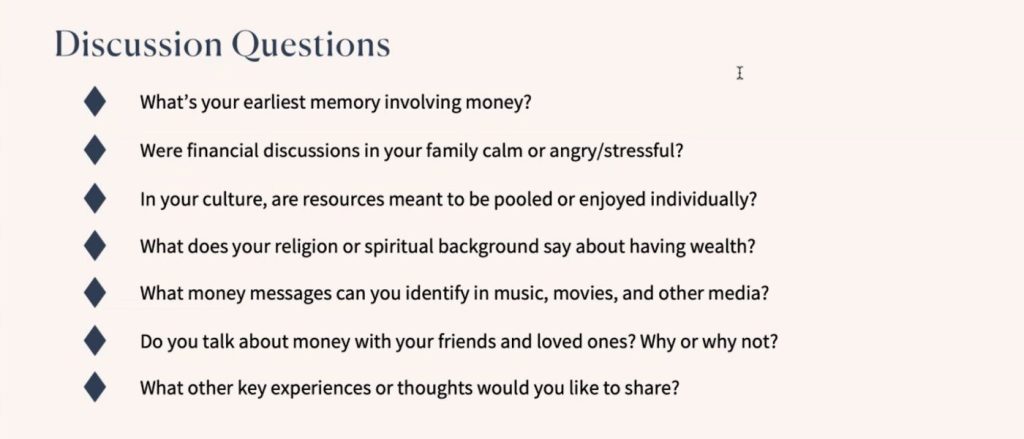

1. How does your family influence your money story?

-

- How did you see your parents or guardians interact with money?

- What financial expectations does your family have for you, if any?

- What generational beliefs have you been holding onto?

2. What is your cultural background around money?

-

- Are resources meant to be pooled, or is the focus more on the individual?

- What “strings” are attached to having money?

- What does having money supposedly say about you? How do we define what “rich” people do vs. “poor” people?

3. How does spirituality or religion affect your relationship with money?

-

- What god-like entities are responsible for bestowing wealth?

- Does money come with a sense of morality?

4. How does the media you consume affect your relationship with money?

-

- How are rich vs. poor fictional characters portrayed? Who’s the protagonist in the story? (i.e. miserly Scrooge McDuck vs. Daddy Warbucks)

- How is wealth glorified in movies and music?

- Does making money necessarily involve “selling out?”

5. How do your friends and your community affect your relationship with money?

-

- Who are you spending time with? How do THEY feel about money?

- Do you talk about your finances with your friends and coworkers?

Your surroundings and experiences influence your money mindset. Think about all the subliminal messages you might have internalized over the years.

— Michelle Waymire

Money exercise: reflecting on your personal history with money

TAKE A MOMENT TO THINK ABOUT THE FOLLOWING QUESTIONS:

Your personal money stories and your relationship to money may be helping or hurting you and your finances. (Or BOTH!)

Common Negative Money Mindsets:

-

- Money is the root of all evil

- If I have money, I just won’t know what to do with it

- If I make money, I’ll only spend it like I always do

- I’m just bad with money

- If I make money, I’ll be selling out

- If you have a passion for something, you should do it for free

Common Positive Money Mindsets:

-

- I love money, and money loves me

- I’m capable of making and sustaining money

- I can be a good person regardless of how much money I have.

- My art/passion is a career.

- I deserve abundance.

- I’m a badass at making money.

Tools for Improving Your Money Mindset and Sense of Abundance

1. Dig into your “why”:

-

- Money mindset work can be a challenge and so can financial change. Your ‘why’ is the secrets sauce that keeps you pumped about the hard work to come.

2. Visualize your abundant life:

-

- It’s a leap of faith if you’ve never felt abundance before, but dreaming about the life you’re working to create can help. Be specific. Make a vision board if possible.

3. Forgive your past mistakes around money or anything else you’re holding onto:

-

- Once you’ve learned from a mistake, it’s okay to move on. The things that helped you survive in the past may not help you thrive in the future.

4. Feel gratitude in life and for the money you already have:

-

- You don’t have to be complacent, but taking stock of what you already have makes the journey so much easier.

5. Practice thinking positively about money:

-

- In order to move towards a better mindset, it can be helpful to brainstorm all the GOOD aspects of money. Focusing on these can help reduce any negative stereotypes about people with money or fear of your own “selling out.”

6. Find your own money mantra:

-

- Your Money Mantra is the overarching phrase or sentence that encompasses how you WANT to think and feel about money. Write and repeat it often!

Example: I’m good at making money by being myself and doing what I love.

7. Use Brooke Castillo’s CTFAR Model:

-

- C: Imagine that your current CIRCUMSTANCES are completely neutral.

- T – It’s your positive or negative THOUGHTS that lend power to your circumstance.

- F – Those thoughts then evoke various FEELINGS.

- A – We take ACTION to increase good feelings, decrease bad ones, or maintain stasis.

- R – Our actions then create RESULTS, which become our new circumstances.

8. Build community to help support your financial goals

-

- That money issue you’re having? Trust me, lots of folks have been there. Now find those people, share ideas and resources, and cheer one another on as you’re working through it. Money is only as taboo as we make it!

9. Create a feeling of abundance for yourself

-

- Abundance Isn’t a Number…It’s a FEELING! Our minds are incredibly powerful, by visualizing what we want and thinking positively it’s amazing what we can manifest. Find some accessible ways to feel good NOW and don’t wait until you’ve reached a finish line.

10. Commit to taking small, daily actions around your finances and money mindset:

-

- Taking even a few minutes each day to engage in the above practices, to continue your financial education, or to engage with your own finances will pay huge dividends over time.

Free Workbook: How To Achieve Your Goals in 6 Key Steps

Want to watch Michelle’s full workshop “Money Mindset Magic” and download the free money mindset magic workbook? Discover and access more financial workshops, tools and resources to help you grow in business. Click here and Join Today!

Michelle Waymire is a fiduciary financial advisor and financial coach, as well as the founder of Young & Scrappy, a specialty practice geared towards serving young professionals, entrepreneurs, and LGBTQ+ folx. Michelle holds her MBA from the University of Tennessee, is a CERTIFIED FINANCIAL PLANNER™, a Chartered Financial Analyst (CFA) charter holder, and has been quoted/featured in US News, Glamour, Bustle, local NPR, and many more.

The Lola is a womxn’s club, workspace and digital community creating space for womxn to connect, grow and thrive.

Do you want to strengthen your network? Intentionally build your connections, resources and support systems? Are you ready to grow, create impact and thrive in your life and in business, all with less hustle and more ease? Let’s get started!