Amy Stone believes that money, while important, doesn’t define her.

The Lola member, Amy Stone has always held true to her value of working with groups where the mission is more valuable than the paycheck. Her values have allowed her to define herself outside of her work. To her, financial security has always been a risk-averse game, and it has allowed her to lead a life that encompasses all of her passions. When she isn’t working on health and science-related communications, you can find her running her family’s farm or training her new Bernadoodle puppy!

Amy Stone

Amy Stone

Location: Atlanta, GA

Age: 61 years

Briefly describe who you are, what you do for work and for fun

I’m a married empty-nester and a self-employed health and science communicator with decades of experience. I work with government agencies and non-profits to help them reach their goals through strategic, measurable communication tactics.

Lots of my work is with CDC, and I worked on the Covid-19 outbreak team at the beginning of the pandemic doing messaging, identifying gaps in the online content.

Recently, I have focused more on data visualization, mentoring science and medical communicators, and giving presentations to healthcare professionals on how best to communicate their work. The foundation of my career is education in the sciences and the arts (BA physiology, BS design science, post-baccalaureate work in physiology and microbiology, masters degree in journalism). Everyone said to pick ONE THING and stick with it, but I loved them all.

That family business meant that my teen summers were spent detasseling corn and cutting weeds out of beans. I learned a lot of leadership skills from those summers – we would hire over one hundred teenagers to work in the fields each summer and by the time I was 16, I was a crew boss driving all these kids around and overseeing their work.

For fun, I read a lot (shout out to the Lola book club for bringing such great books into my life!), watch Netflix, and train our dog (a rescue Bernadoodle that came with a lot of, um, challenges). She’s doing great now. I’m looking forward to being able to travel again, but overall, I’ve had an enriching time cutting back on activities due to covid.

How did you land upon your professional path? Who or what inspired you into taking this path?

I was headed to medical school and was doing some post-baccalaureate work studying physiology and studying for the MCAT. But, my dad suddenly fell ill and died, and the time I spent in hospitals with him made me see that I didn’t really want to be a doctor.

I did the opposite of what you’re supposed to do when experiencing grief – I made massive changes!

I dropped out of school, moved to Atlanta to get a fresh start, and started working in a cancer research lab at Emory, thinking I’d probably get a Ph.D. But, I hated it! What I really loved was learning about science and medicine and then telling people about them, so I switched gears and got a masters degree in communications/journalism and have been communicating science and medicine ever since.

Unfortunately, I did not really have any mentors at the beginning of my career, a situation that negatively affected me.

No one reached out to me when I dropped my plans for medical school to counsel me on the myriad ways to use a medical degree other than hands-on patient care. I didn’t know any science writers. I sort of floundered and found my path on my own, but I could have saved time and been more intentional if I had had mentors. It wasn’t until my 3rd job in Atlanta that I had a female boss who was about 20 years older than me who helped me visualize career progression and who opened some doors for me.

What do you do (for work or fun) to align with your values?

Fortunately, my work aligns with my values. With my company, I try to practice “servant leadership,” and provide support and benefits to my clients and to the people who work for me. I enjoy serving on boards and have been a trustee at my kids’ elementary school, a member of the Georgia ACLU board, and on the board for the AIDS Quilt (Names Project). I chaired that board for a few years. Currently, I am on the Founding Members Board here at the Lola.

Another way I live my values through my work is believing that all work has value.

Specifically, I do not believe in unpaid internships. For the past 10 years or so, I’ve used interns and they earn $15/hour and we set goals about what skills they want to learn or get better at and what my needs are from them. I am currently without an intern because my last one now contracts with me as an entry-level writer and copy editor while she is in graduate school. She now makes a good bit more than $15/hour and she’s worth it because I trained her and now she has real, marketable skills that she can apply to many professions.

How do you define success for yourself? What ideas of success do you reject?

Success to me has always been about flexibility and living a self-directed life.

I’ve been self-employed since 1994 and struck out on my own because it always seemed artificial to dedicate 9-5 (or more) to a job that you may not have to physically be present for those specific hours. I also thought my idea for a business was a good model.

There are many benefits to working for a company – matching retirement, healthcare, and paid days off are just a few, but I grew to view those perks as “velvet handcuffs,” that keep you in a position you don’t really love.

I have not had a paid sick day or vacation day in 27 years, but, I was also able to take off 3 months with each of my kids when they were born and work around their schedules, if needed when they were growing up, as well as work remotely. Even before the pandemic, my clients have not known if I am in IL visiting my mom, finishing a project in Ireland on a holiday, or watching one of my kids’ sporting events.

I reject the notion that your work is your identity.

When I began working, people didn’t really talk about their families, and you’d go out of your way not to use your kids or yourself as an excuse for leaving early or taking a day off unless you were sick. In fact, you tried to give the impression that your work was the central thing in your life. That’s ridiculous and completely minimizes the human experience. I’ve tried to integrate work with the rest of my life but did have to learn to set boundaries.

I also reject the concept that success is an individual thing. My success is built on my parents’ investment in me, and their ancestors’ investments in them. In fact, the nucleus of our family farm was part of the westward expansion and my great greats bought the land from the Jackson administration in 1834. Not everyone had that opportunity – my ancestors came from Boston and were educated and took advantage of the Homestead Act, which deeded you land if you lived on it and improved it.

It wasn’t until I was an adult that I questioned why there were no Black farmers in the community. Once you start looking at the data and realize that my family had opportunities that were denied to others, because of slavery or racism or native relocation, it is clear that I started on third base.

What is your relationship with money? How does money make you feel?

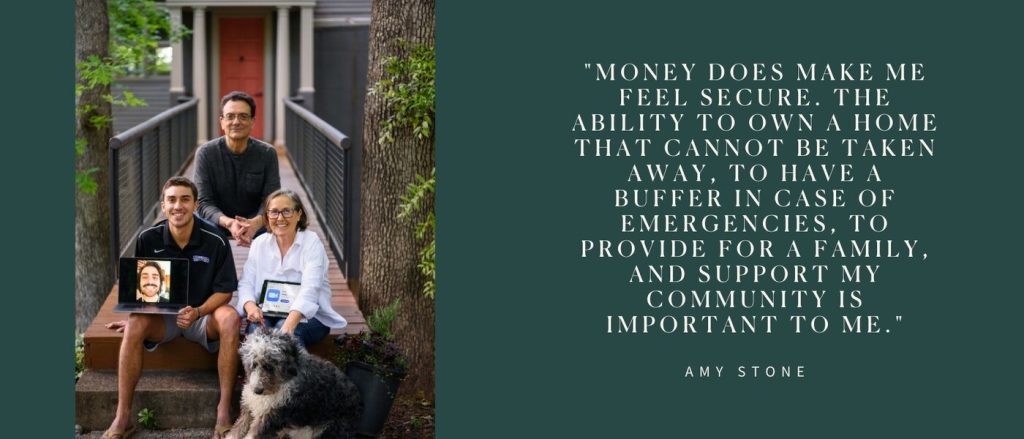

I tend to value the security money gives me, probably because I’ve foregone a regular paycheck. It’s only in the past few years that I’ve seen that our planning is working and I’ve relaxed some. My husband and I are lucky to have had a series of good financial advisors who helped us, years ago, set up 529 plans for college expenses, and advised me on self-employment retirement plans.

Our current advisor has a saying “Every dollar needs a job” and I think that’s a great way to think of your money.

If it is sitting in a low-interest account, it should be for a reason, such as it’s going to be used for a big purchase soon. It’s really a strange feeling when you start to dismantle the plans – when we first started taking out 529 money for our oldest’s education, it felt a little scary, and like we still should be saving!

Overall, I think I overemphasize the security angle of money and I can easily recall a few examples that would have been fruitful if I was more risk-inclined.

All three had to do with real estate – buildings I liked in growing areas right before those areas exploded. But, money was tight from a lending perspective and it was very difficult to get loans for investment properties (these were all after recessions, in 2002 and in 2008), and we chose to keep our money where it was. Safe, but definitely a little too conservative.

What lessons were you taught about money growing up (saving, investing, debt, earning, etc.)?

I got a savings account at a young age, sometime in elementary school, and a checking account when I started high school. The savings account had a little blue passbook that the friendly bank teller would handwrite the deposits and add the interest and record the balance. Any birthday or holiday gift money went into the savings account and I remember when I learned about interest. They were paying me to use my money! Of course, interest rates were higher then and it was a better lesson for a kid. My checking account was where some of my money from jobs went (some went to savings) and I pretty much could do what I wanted with it. I was also fortunate in that I was in 4-H, which, at that time, was a great basis for learning about business.

It was completely geared toward future traditional (and heterosexual) relationships where the men would make the money and the women would be frugal with it.

I was fortunate that my parents encouraged me to do both 4-H clubs. I think the organization is now just “4-H” and I hope all kids have the freedom to choose what they will learn, whether it is sewing or small engine repair or show horses, and not be funneled into courses based on their gender.

There is a lot of financial uncertainty in farming. Often farmers get an operating loan at the beginning of the year to purchase grain and inputs and pay it back after harvest. These loans are often quite large and you want to be able to pay them back so you can avoid extra interest payments and keep good credit so you can repeat the cycle the next year. Farm machinery is very expensive…those large expenses taught me about depreciation. So, I absorbed some fairly basic tax lessons, as well as conservative lessons about saving, investing, and planning ahead during my formative years.

I suppose being debt-averse stems from those early lessons. Overall, you have a lot more choices in life if you don’t have debt, but sometimes, debt can be useful.

How have you overcome any early beliefs or patterns around money?

I don’t know if I’ve overcome them! I tried to instill the same conservative approach with my kids – live within your means or a little under if you can, pay off your credit cards every month, generally don’t buy things you can’t pay cash for unless they appreciate, how to budget, how to save, set your goals, work toward them, and share if you can. I’d like to be a little less debt-averse, but this is not the time of my life to start down that path!

How does money play into how you make big decisions about your life and career?

Money has played a large role. We knew we wanted to educate our kids well, and that takes a lot of money. We worked our way up to a nice neighborhood, and that takes money. And we prize travel for the many rewards it brings. When you are clear on your goals, you can prioritize them, and for many years, we prioritized education and vacation, which meant we stayed in a too-small house for too long because we just couldn’t do it all at one time. It helped to have some perspective on this – I’ve done public health work around the globe and knew that our too-small home would be considered a mansion by many (that doesn’t mean I didn’t pine for that additional bedroom!). So, I built my career with an eye toward both flexibility and security and we had solid goals we were shooting for.

Because neither my husband nor I are in super high-paying careers (we do well, but we’re not heart surgeons!), we created multiple streams of revenue to get to where we wanted to go.

Being a landlord on top of full-time jobs and family obligations is not easy, though. We’ve had to get up in the middle of the night to fix a broken pipe, deal with air conditioning problems while out of town (which was urgent because it was during one of Atlanta’s beastly heat waves), been ghosted by a tenant who left in the middle of the night, and so on.

Being a landlord on top of full-time jobs and family obligations is not easy, though. We’ve had to get up in the middle of the night to fix a broken pipe, deal with air conditioning problems while out of town (which was urgent because it was during one of Atlanta’s beastly heat waves), been ghosted by a tenant who left in the middle of the night, and so on.

Money has also played a big role in the current structure of my business. Originally, my model was to build more of a specialized agency, taking on clients and ramping up to meet their needs.

I did a lot of individual projects, such as a CME course on genetics for a university, but during the dot com bust in the early 2000s, many of my clients cut back and put projects on hold that they would normally hire me for. That coincided with both of my kids being in an independent school and the vague concept of funding college educations starting to become a reality. So, I altered my business structure and started taking government contracts that would give me a known baseline income. Because contracts are often for 4 or 5 years, they give you a very secure base (only if you do a good job; they are reviewed annually). So, the government work is a large part of my base, and I have another annual contract with a national non-profit that serves as the 2nd part of my base. I can then take on other projects as they come in.

Do you approach money in your business and your personal finances in the same or different ways?

When we moved to our current home, our kids were old enough that we could get rid of all their preschool and elementary school toys and paraphernalia. We donated a lot to schools and the public library, had a garage sale, and gave away what we could to other families, but we still had an entire carport of stuff that was going to the Goodwill. As I walked through it all, I was overcome with great sadness that we had worked so hard for things that had no lasting value to us.

That just exemplifies the two ends of the financial security equation – there is the part that comes in and the part that goes out. Maximizing the input and minimizing the output not only helps build financial security, it’s the right thing to do for the planet, and frankly, for kids because they don’t need nearly as much as we are led to believe.

There have been times when I operated from a competitive and scarcity mindset – as if there wasn’t enough pie to go around and I hoarded my share. I really did let “comparison be the thief of joy.” Those were not good times, and reflected my insecurities and deprived me of being happy for others. As I have moved through life, and especially with the gift of hindsight, I have learned the satisfaction of a cooperative, collaborative approach of building a bigger table (or pie) where more people can win/win. This, paradoxically, has loosened up my approach to money somewhat by making me realize that while money is important, it is not a reflection of who I am.

Finally, I love to give money away. In fact, that’s the only reason I would want to be super-rich. What a great thing to be able to make a big difference. To that end, I have been following MacKenzie Scott (formerly married to Jeff Bezos). She is setting a great philanthropic example for the billionaires in this country.